Payroll Information Form. How to complete the request for payroll information form (ins5097). A payroll verification form is an essential document for obtaining an efficient verification process. You need this information in. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. ❖ enroll in direct deposit or maintenance direct deposit. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. The irs website also provides more detailed information on the forms themselves. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. Form 1099 refers to a series of documents made available through the irs. Mostly, it will have three areas which are designated for varying people or authorities. Calculating payroll taxes and getting your team paid is a critical step to running your small business. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. Payroll forms include information about employee wages and withholdings.

Payroll Information Form : If You Have Not Received Your Superannuation Choice Forms Please Contact The Payroll Team.

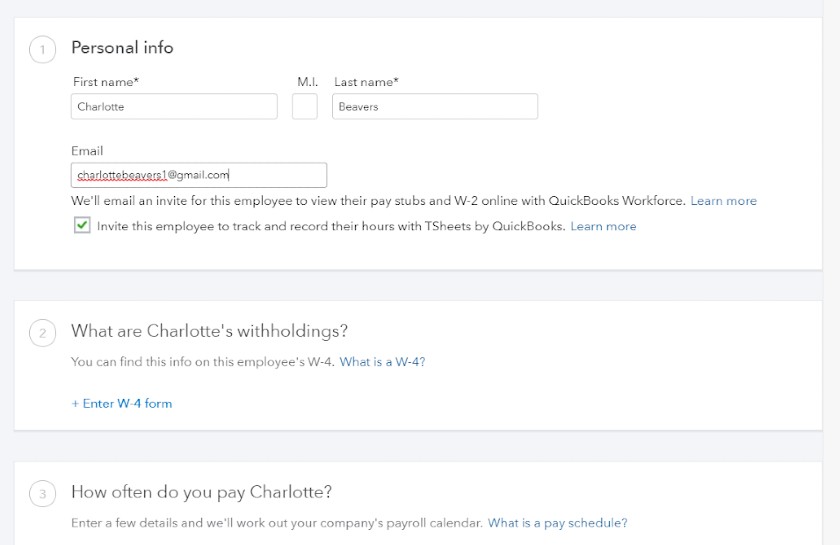

Employee Forms W 4 And I 9 Forms Connectpay. Payroll forms include information about employee wages and withholdings. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. ❖ enroll in direct deposit or maintenance direct deposit. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. A payroll verification form is an essential document for obtaining an efficient verification process. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. Mostly, it will have three areas which are designated for varying people or authorities. The irs website also provides more detailed information on the forms themselves. You need this information in. Form 1099 refers to a series of documents made available through the irs. Calculating payroll taxes and getting your team paid is a critical step to running your small business. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. How to complete the request for payroll information form (ins5097). Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. All employers must pay taxes for each person they employ, and report this information to the internal revenue service.

The irs and other government agencies have extensive information, resources, and documentation available to employers to assist with a variety of we also have forms only clients of complete payroll would need.

Any additional information needed for a particular jurisdiction's tax forms is entered in the appropriate additional information dialog. Calculating payroll taxes and getting your team paid is a critical step to running your small business. Access forms, videos, user guides and much more. We use this information to make the website work as well as possible and improve government services. Read/download procedures that accompany each form. Provided are some of the most common payroll resources you might need including our training videos. If you need a free download of adobe. The 9 payroll forms you need: Payroll forms include information about employee wages and withholdings. Along with the amounts that each employee should receive for. We believe in connecting church leaders to information and resources that will empower them to successfully grow their ministries. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. Internal revenue service (irs) form used to provide tax information for visitors. ❖ enroll in direct deposit or maintenance direct deposit. Home employee information tax information calendar forms resources about us contact us. Employee direct deposit enrollment form. A payroll verification form is an essential document for obtaining an efficient verification process. Training, tools, links, videos and more. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. A company's payroll is the list of employees of that company that are entitled to receive pay and the amounts that each should receive. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. Retroactive pay request form xlsx. Form 1099 refers to a series of documents made available through the irs. How to complete the request for payroll information form (ins5097). Type in all requested info, then print off and sign in ink). Like input worksheet instructions, payroll account change authorization, and. Download the most common forms, tables and helpbooks for setting up and running a payroll system with or without payroll software. To view information about the fields in the additional information dialog for each jurisdiction, click the links below. Any additional information needed for a particular jurisdiction's tax forms is entered in the appropriate additional information dialog. Payroll forms & other forms. Mostly, it will have three areas which are designated for varying people or authorities.

What Is A W 3 Form And How Do I File It Gusto , The Documents Are In Adobe Acrobat Format.

Digital Forms For Employee Onboarding Exacthire. Calculating payroll taxes and getting your team paid is a critical step to running your small business. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. A payroll verification form is an essential document for obtaining an efficient verification process. You need this information in. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. How to complete the request for payroll information form (ins5097). Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. Payroll forms include information about employee wages and withholdings. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. Form 1099 refers to a series of documents made available through the irs. Mostly, it will have three areas which are designated for varying people or authorities. The irs website also provides more detailed information on the forms themselves. ❖ enroll in direct deposit or maintenance direct deposit. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department.

Free 20 Payroll Forms In Excel - Along With The Amounts That Each Employee Should Receive For.

Employee Personal Information Form Template Employment Form Employment Application Job Application. Payroll forms include information about employee wages and withholdings. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. The irs website also provides more detailed information on the forms themselves. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. ❖ enroll in direct deposit or maintenance direct deposit. How to complete the request for payroll information form (ins5097). Mostly, it will have three areas which are designated for varying people or authorities. Calculating payroll taxes and getting your team paid is a critical step to running your small business. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. You need this information in.

The Zenith Payroll Report Form . Employee direct deposit enrollment form.

Payroll Change Form 3 Part Employee Payroll Changes Hrdirect. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. How to complete the request for payroll information form (ins5097). Payroll forms include information about employee wages and withholdings. Form 1099 refers to a series of documents made available through the irs. You need this information in. ❖ enroll in direct deposit or maintenance direct deposit. Mostly, it will have three areas which are designated for varying people or authorities. A payroll verification form is an essential document for obtaining an efficient verification process. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. Calculating payroll taxes and getting your team paid is a critical step to running your small business. The irs website also provides more detailed information on the forms themselves. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department.

Free 9 Sample Employee Update Forms In Ms Word Pdf - Calculating Payroll Taxes And Getting Your Team Paid Is A Critical Step To Running Your Small Business.

11 Printable Payroll Change Form Word Document Templates Fillable Samples In Pdf Word To Download Pdffiller. ❖ enroll in direct deposit or maintenance direct deposit. You need this information in. How to complete the request for payroll information form (ins5097). The irs website also provides more detailed information on the forms themselves. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. Calculating payroll taxes and getting your team paid is a critical step to running your small business. Mostly, it will have three areas which are designated for varying people or authorities. A payroll verification form is an essential document for obtaining an efficient verification process. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. Payroll forms include information about employee wages and withholdings. Form 1099 refers to a series of documents made available through the irs. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. Click the links above to take a closer look at any of the payroll tax forms discussed in this article.

W 2 Wages And Salaries Taxable Irs And State Income On A W2 . The 9 Payroll Forms You Need:

Employee Payroll Employee Payroll Information Sheet. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. How to complete the request for payroll information form (ins5097). You need this information in. ❖ enroll in direct deposit or maintenance direct deposit. Payroll forms include information about employee wages and withholdings. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. The irs website also provides more detailed information on the forms themselves. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. A payroll verification form is an essential document for obtaining an efficient verification process. Mostly, it will have three areas which are designated for varying people or authorities. Form 1099 refers to a series of documents made available through the irs. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. Calculating payroll taxes and getting your team paid is a critical step to running your small business.

Employee Personal Information Form Template Employment Form Employment Application Job Application , Click The Links Above To Take A Closer Look At Any Of The Payroll Tax Forms Discussed In This Article.

Free 10 Sample Employee Information Forms In Pdf Ms Word. Form 1099 refers to a series of documents made available through the irs. Calculating payroll taxes and getting your team paid is a critical step to running your small business. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. Mostly, it will have three areas which are designated for varying people or authorities. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. The irs website also provides more detailed information on the forms themselves. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. Payroll forms include information about employee wages and withholdings. A payroll verification form is an essential document for obtaining an efficient verification process. You need this information in. How to complete the request for payroll information form (ins5097). ❖ enroll in direct deposit or maintenance direct deposit. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime.

What Is A W 3 Form And How Do I File It Gusto : All Employees Should Complete This Form As Soon As You Hire Them.

Free 12 Sample Employee Payroll Forms In Pdf Excel Word. The irs website also provides more detailed information on the forms themselves. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. How to complete the request for payroll information form (ins5097). Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. Form 1099 refers to a series of documents made available through the irs. A payroll verification form is an essential document for obtaining an efficient verification process. Calculating payroll taxes and getting your team paid is a critical step to running your small business. ❖ enroll in direct deposit or maintenance direct deposit. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. Payroll forms include information about employee wages and withholdings. Mostly, it will have three areas which are designated for varying people or authorities. You need this information in. Click the links above to take a closer look at any of the payroll tax forms discussed in this article.

Free 21 Sample Payroll Forms In Ms Word Pdf Excel . Internal Revenue Service (Irs) Form Used To Provide Tax Information For Visitors.

Free 12 Sample Employee Payroll Forms In Pdf Excel Word. You need this information in. Mostly, it will have three areas which are designated for varying people or authorities. A payroll verification form is an essential document for obtaining an efficient verification process. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. Payroll forms include information about employee wages and withholdings. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. ❖ enroll in direct deposit or maintenance direct deposit. How to complete the request for payroll information form (ins5097). Form 1099 refers to a series of documents made available through the irs. Calculating payroll taxes and getting your team paid is a critical step to running your small business. The irs website also provides more detailed information on the forms themselves.

11 Printable Payroll Change Form Word Document Templates Fillable Samples In Pdf Word To Download Pdffiller . Home Employee Information Tax Information Calendar Forms Resources About Us Contact Us.

Free 21 Sample Payroll Forms In Ms Word Pdf Excel. How to complete the request for payroll information form (ins5097). You need this information in. Calculating payroll taxes and getting your team paid is a critical step to running your small business. Form 1099 refers to a series of documents made available through the irs. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. Mostly, it will have three areas which are designated for varying people or authorities. A payroll verification form is an essential document for obtaining an efficient verification process. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. ❖ enroll in direct deposit or maintenance direct deposit. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. Payroll forms include information about employee wages and withholdings. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. The irs website also provides more detailed information on the forms themselves.

Payroll Forms Pool Personnel : Section 126(14) Of The Employment Insurance Act, Gives Employment And Social Development Canada (Esdc) The Authority To Request Information On Named Individuals From Employers.

Payroll Status Change Notice Forms Zbp Forms. You need this information in. Calculating payroll taxes and getting your team paid is a critical step to running your small business. Click the links above to take a closer look at any of the payroll tax forms discussed in this article. The form will act as a sort of information form as it centers on what needs to be validated by the payroll department. Mostly, it will have three areas which are designated for varying people or authorities. Payroll forms include information about employee wages and withholdings. Form 1099 refers to a series of documents made available through the irs. Payroll forms — also known as payroll reports — are a means of accruing and organizing accounting information about a business' employees. ❖ enroll in direct deposit or maintenance direct deposit. The irs website also provides more detailed information on the forms themselves. Section 126(14) of the employment insurance act, gives employment and social development canada (esdc) the authority to request information on named individuals from employers. All employers must pay taxes for each person they employ, and report this information to the internal revenue service. Whenever you hire a new employee the dol requires you to track employee payroll information like weekly hours worked, wages and earned overtime. How to complete the request for payroll information form (ins5097). A payroll verification form is an essential document for obtaining an efficient verification process.