Partial Release Of Lein. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. It is used by a lienholder to reduce part of the amount originally owed to a supplier. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. Generally, the priority of liens is determined by the order of the recording date. It is used when a portion of the claim amount has been paid, but not the full amount. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. In other words, it reduces the amount claimed to be owed. A partial release of lien, releases an original mechanic's lien claim moderately. Timely release of the lien is essential. Consequently, partial lien releases and partial lien waivers are distinct from each other. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; A partial release of lien only releases a specific piece of property from a recorded state tax lien. The county name where the release is conducted will be the first data to be stated in the form. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim.

Partial Release Of Lein: Under California Law, Priority Between State And Federal Tax Liens Is Determined When Each Liability Was First Created (The.

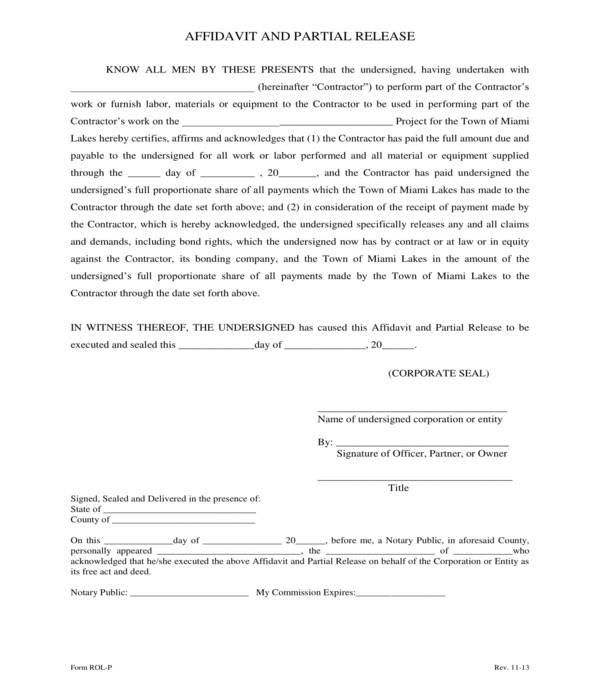

Template Free 7 Lien Waiver Forms In Pdf Ms Word Throughout Partial Lien Waiver Template Partial Lien Waiver Template Partial Lien Waiver Form New York Partial Lien Waiver Form Minnesota. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim. Timely release of the lien is essential. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. The county name where the release is conducted will be the first data to be stated in the form. A partial release of lien only releases a specific piece of property from a recorded state tax lien. A partial release of lien, releases an original mechanic's lien claim moderately. In other words, it reduces the amount claimed to be owed. It is used when a portion of the claim amount has been paid, but not the full amount. It is used by a lienholder to reduce part of the amount originally owed to a supplier. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. Generally, the priority of liens is determined by the order of the recording date. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. Consequently, partial lien releases and partial lien waivers are distinct from each other. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising;

Whether you are an owner paying a general contractor or a general contractor paying a determining whether the lien release you are signing is a final or partial lien waiver can sometimes be difficult.

The county name where the release is conducted will be the first data to be stated in the form. When the irs releases a tax lien, it clears the statutory tax lien for your debt as well as the public ntfl. The irs does this by filing a certificate of release of federal tax lien. Timely release of the lien is essential. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim. Collection of most popular forms in a given sphere. In considering an application for a partial release of a lien, the commissioner may require further evidence or documentation, such as a supporting appraisal of the property. A partial release of lien only releases a specific piece of property from a recorded state tax lien. If the debt is paid in part, with part of it released and the borrower put on parole, what you have is a conditional release. Partial releases of a tax lien. Consequently, partial lien releases and partial lien waivers are distinct from each other. Understanding the lien release form. The lien is the conditional rights a borrower has on a property, until the debt is completely paid off. A release of lien is a written statement that removes your property from the threat of lien. This will reduce the likelihood, or at least the efficacy, of a claim that a party did not understand any new terms or how those might affect the arrangement identifies the document as a partial release and waiver of liens. A lien gives the lien holder (the subcontractor) an assurance that they will get paid by giving them a claim against the real property. Generally, the priority of liens is determined by the order of the recording date. A lien release usually comes up when it is time to make payment. Before you make any payment, be sure you receive this • if your contract calls for partial payments before the work is completed, get a partial release of lien covering all workers and materials used to that point. It is used by a lienholder to reduce part of the amount originally owed to a supplier. A partial release of lien, releases an original mechanic's lien claim moderately. A partial release occurs when the lien holder agrees to release some of your property from a lien. A partial lien release form helps to reduce the amount claimed to be owed by a tradesperson's lien. A conditional lien release means you make arrangements to pay the lien by issuing a payment to the lien holder. A partial release of lien is a document that works as a receipt for a partial payment on a project, usually for construction or labor, for the release of any type of lien that may currently exist or will in the future. Whether you are an owner paying a general contractor or a general contractor paying a determining whether the lien release you are signing is a final or partial lien waiver can sometimes be difficult. Fill, sign and send anytime, anywhere, from any device with pdffiller. Brief description of partial release of lien certificate: Savesave partial lien release for later. Your loan contract will have to. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds.

Contractor Release Form Final Waiver Of Lien Release Forms Release Forms, Your Loan Contract Will Have To.

Partial Waiver Of Lien Lpb 06 05 Ir Pdf Fpdf Docx Washington. It is used by a lienholder to reduce part of the amount originally owed to a supplier. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. Consequently, partial lien releases and partial lien waivers are distinct from each other. A partial release of lien, releases an original mechanic's lien claim moderately. Timely release of the lien is essential. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. It is used when a portion of the claim amount has been paid, but not the full amount. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. In other words, it reduces the amount claimed to be owed. A partial release of lien only releases a specific piece of property from a recorded state tax lien. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. The county name where the release is conducted will be the first data to be stated in the form. Generally, the priority of liens is determined by the order of the recording date.

Subcontractor Final Lien Waiver And Release Complete Legal Document Online Us Legal Forms - It Is Used By A Lienholder To Reduce Part Of The Amount Originally Owed To A Supplier.

Lien Release 101 Canceling Construction Mechanics Liens Handle. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. Consequently, partial lien releases and partial lien waivers are distinct from each other. It is used by a lienholder to reduce part of the amount originally owed to a supplier. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. The county name where the release is conducted will be the first data to be stated in the form. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. A partial release of lien, releases an original mechanic's lien claim moderately. Generally, the priority of liens is determined by the order of the recording date. Timely release of the lien is essential. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed.

Free Partial Release Of Lien Forms Templates Word Pdf : Subcontractor/supplier waiver and partial release of lien upon progress payment (conditional) the undersigned lienor, as subcontractor.

Partial Waiver Of Liens Claims For Contractors 7 99 Download Now. In other words, it reduces the amount claimed to be owed. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. Timely release of the lien is essential. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. A partial release of lien, releases an original mechanic's lien claim moderately. It is used when a portion of the claim amount has been paid, but not the full amount. Generally, the priority of liens is determined by the order of the recording date. A partial release of lien only releases a specific piece of property from a recorded state tax lien. Consequently, partial lien releases and partial lien waivers are distinct from each other. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; It is used by a lienholder to reduce part of the amount originally owed to a supplier. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. The county name where the release is conducted will be the first data to be stated in the form. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim.

When To Use A Florida Waiver And Release Of Lien Upon Progress Payment Handle . When The Irs Releases A Tax Lien, It Clears The Statutory Tax Lien For Your Debt As Well As The Public Ntfl.

Infographic Release Of Lien Ncs Credit. A partial release of lien only releases a specific piece of property from a recorded state tax lien. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim. A partial release of lien, releases an original mechanic's lien claim moderately. It is used when a portion of the claim amount has been paid, but not the full amount. In other words, it reduces the amount claimed to be owed. The county name where the release is conducted will be the first data to be stated in the form. It is used by a lienholder to reduce part of the amount originally owed to a supplier. Generally, the priority of liens is determined by the order of the recording date. Consequently, partial lien releases and partial lien waivers are distinct from each other. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. Timely release of the lien is essential. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien.

11 Construction Release Form Templates Doc Pdf Free Premium Templates - A Lien Gives The Lien Holder (The Subcontractor) An Assurance That They Will Get Paid By Giving Them A Claim Against The Real Property.

Partial Lien Release In Word And Pdf Formats. A partial release of lien, releases an original mechanic's lien claim moderately. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. Generally, the priority of liens is determined by the order of the recording date. Consequently, partial lien releases and partial lien waivers are distinct from each other. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; The county name where the release is conducted will be the first data to be stated in the form. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. A partial release of lien only releases a specific piece of property from a recorded state tax lien. It is used when a portion of the claim amount has been paid, but not the full amount. It is used by a lienholder to reduce part of the amount originally owed to a supplier. Timely release of the lien is essential. In other words, it reduces the amount claimed to be owed.

Free 6 Partial Release Of Lien Forms In Pdf , Upon Receipt Of Final Payment.

Notice To Owner Do It Yourself Lien Release. The county name where the release is conducted will be the first data to be stated in the form. A partial release of lien only releases a specific piece of property from a recorded state tax lien. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. Consequently, partial lien releases and partial lien waivers are distinct from each other. In other words, it reduces the amount claimed to be owed. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. It is used by a lienholder to reduce part of the amount originally owed to a supplier. Timely release of the lien is essential. Generally, the priority of liens is determined by the order of the recording date. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. A partial release of lien, releases an original mechanic's lien claim moderately. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; It is used when a portion of the claim amount has been paid, but not the full amount. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim.

Partial Release Of Judgment Lien Texas Legal Forms By David Goodhart Pllc , And (Ii)The Purchaser's Lien Upon And Security Interest In The Following Collateral, Including Any Proceeds.

Construction Management Easy Pro Manager. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. It is used by a lienholder to reduce part of the amount originally owed to a supplier. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; It is used when a portion of the claim amount has been paid, but not the full amount. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. Consequently, partial lien releases and partial lien waivers are distinct from each other. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. In other words, it reduces the amount claimed to be owed. A partial release of lien, releases an original mechanic's lien claim moderately. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim. Generally, the priority of liens is determined by the order of the recording date. Timely release of the lien is essential. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. The county name where the release is conducted will be the first data to be stated in the form. A partial release of lien only releases a specific piece of property from a recorded state tax lien.

Free Florida Lien Release Form Pdf 17kb 4 Page S , The Direct Contractor, Subcontractor Or Materials Supplier Would Then Have The Reduced Amount Adjusted Accordingly, While Still Maintaining The Right To The Lien Until All Funds Have Been Received In Full.

Contractor Release Form Final Waiver Of Lien Release Forms Release Forms. Timely release of the lien is essential. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim. The county name where the release is conducted will be the first data to be stated in the form. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. Consequently, partial lien releases and partial lien waivers are distinct from each other. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. It is used when a portion of the claim amount has been paid, but not the full amount. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; A partial release of lien, releases an original mechanic's lien claim moderately. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. A partial release of lien only releases a specific piece of property from a recorded state tax lien. In other words, it reduces the amount claimed to be owed. Generally, the priority of liens is determined by the order of the recording date. It is used by a lienholder to reduce part of the amount originally owed to a supplier.

Colorado Partial Conditional Lien Waiver Form Free , This Is A Form Of A Partial Release Of Judgment Lien.

Calif Partial Release Of Mechanic S Lien. The county name where the release is conducted will be the first data to be stated in the form. It is used when a portion of the claim amount has been paid, but not the full amount. In other words, it reduces the amount claimed to be owed. Generally, the priority of liens is determined by the order of the recording date. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; A partial release of lien, releases an original mechanic's lien claim moderately. A partial release of lien only releases a specific piece of property from a recorded state tax lien. Consequently, partial lien releases and partial lien waivers are distinct from each other. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim. It is used by a lienholder to reduce part of the amount originally owed to a supplier. Timely release of the lien is essential. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien.

Partial Release Of Mortgage Form Fill Online Printable Fillable Blank Pdffiller - A Release Of Lien Is A Written Statement That Removes Your Property From The Threat Of Lien.

5 12 3 Lien Release And Related Topics Internal Revenue Service. And (ii)the purchaser's lien upon and security interest in the following collateral, including any proceeds. The direct contractor, subcontractor or materials supplier would then have the reduced amount adjusted accordingly, while still maintaining the right to the lien until all funds have been received in full. In other words, it reduces the amount claimed to be owed. It is used when a portion of the claim amount has been paid, but not the full amount. It is used by a lienholder to reduce part of the amount originally owed to a supplier. Consequently, partial lien releases and partial lien waivers are distinct from each other. A partial release of lien, releases an original mechanic's lien claim moderately. The county name where the release is conducted will be the first data to be stated in the form. Timely release of the lien is essential. A partial release of lien releases any mechanic lien claim on a property by reducing the amount that is claimed to be owed. Irc § 7432 gives taxpayers the right to sue the federal government if the service knowingly or negligently fails to request a lien release be manually input to als, prepare form 13794, request for release or partial release of notice of federal tax lien. A partial release of lien only releases a specific piece of property from a recorded state tax lien. (i)ariad uk is hereby released and discharged from any and all debts, liabilities and obligations under the security agreement, whether now existing or hereafter arising; Generally, the priority of liens is determined by the order of the recording date. Confusion is not uncommon, however as the name suggests, a partial release of lien (or partial lien release) partially releases a mechanics lien claim.