Medical Expense Forms. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. Many medical expenses are tax deductible if you itemize deductions. You'll need to show that you've had. The charges accumulated by the patient are listed down in the next section. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. Here's how someone deducts medical expenses from their taxes. Can you claim medical expenses on your taxes this year? The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. It medical expense form starts off with the patient's general information. First, calculate agi by following instructions found on the first page of form 1040. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and.

Medical Expense Forms- While The Medical Expense Deduction Plays An Important Role In Ensuring That Households With High Medical Costs Receive Adequate Benefits, It Is Federal Snap Rules Require Verification Of Medical Expenses.

Wsib Travel Expense Form Fill Out And Sign Printable Pdf Template Signnow. It medical expense form starts off with the patient's general information. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. The charges accumulated by the patient are listed down in the next section. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. Can you claim medical expenses on your taxes this year? You'll need to show that you've had. Many medical expenses are tax deductible if you itemize deductions. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. First, calculate agi by following instructions found on the first page of form 1040. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. Here's how someone deducts medical expenses from their taxes. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses.

If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a.

How to request deductions for housing. This section will explain the types of expenses that qualify for relief and how you. Collection of most popular forms in a given sphere. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. Unfortunately, misjudging the costs of medical expenses can easily derail retirement plans and drain savings. Schedule a is separated into sections for different categories of deductible expenses. Once you have totaled the expenses for each category, you add them up and put the grand total on your form 1040. How to request deductions for housing. Here is a list of healthcare forms, commuter forms, dependent care forms, cobra forms, eligible expenses forms, and more. First, calculate agi by following instructions found on the first page of form 1040. Medical office startup expenses sometimes become way too much to handle and one needs proper information in the form of data. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. States have flexibility in how to meet this requirement, and some state practices create. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. If you pay medical expenses that are not covered by the state or by private health insurance a medical form med2 (pdf) is a receipt to prove your dental expenses. Filter by account type and expense type to learn about qualified medical expenses. The question asks about reimbursement for expenses, not paying benefits for death, dismemberment, or loss of income. Many medical expenses are tax deductible if you itemize deductions. Here's how someone deducts medical expenses from their taxes. Medical costs include the expenses of equipment, supplies, and diagnostic devices needed for the purposes listed above. It medical expense form starts off with the patient's general information. These can be your own health expenses, those of a family member or any individual's, as long as you paid for them. Medical expenses of spouses and dependents; Otherwise you can ask your doctor to write down and sign a list of recommended items: Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. Fillable medical mileage expense form. Complete the form below and nerdwallet will share your information with facet wealth so they can contact you. The charges accumulated by the patient are listed down in the next section. Additionally, you should only claim this deduction if it is higher than. Qualified medical expenses (qme) are designated by the irs.

Can I Claim Medical Expenses On My Taxes Turbotax Tax Tips Videos- How To Request Deductions For Housing.

Fsa Claim Form Medical Manualzz. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. Many medical expenses are tax deductible if you itemize deductions. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. You'll need to show that you've had. It medical expense form starts off with the patient's general information. Here's how someone deducts medical expenses from their taxes. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. Can you claim medical expenses on your taxes this year? The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. First, calculate agi by following instructions found on the first page of form 1040. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. The charges accumulated by the patient are listed down in the next section.

Repeal Of Medical Deduction Prompts Tax Bill Pushback , They Have Traditionally Offered Benefits In The Form Of Services, Not Indemnity Or Reimbursement Plans.

Free 5 Medical Receipt Templates In Pdf. You'll need to show that you've had. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. Here's how someone deducts medical expenses from their taxes. Many medical expenses are tax deductible if you itemize deductions. The charges accumulated by the patient are listed down in the next section. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses.

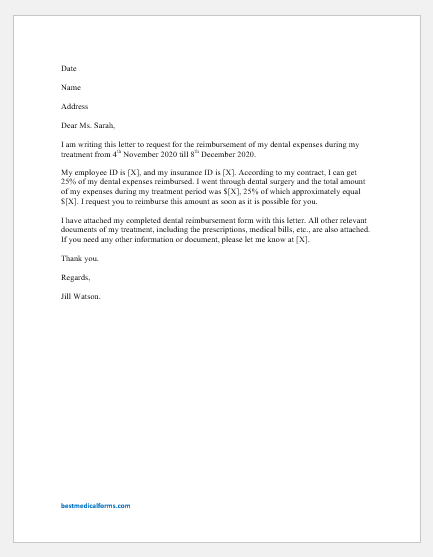

Sample Dental Expense Claim Form Medical Forms Form Word Template Dental : They make payments directly to the providers of.

How To Track Your Hsa Spending In A Spreadsheet Tracking Medical Exp Golagoon. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. Here's how someone deducts medical expenses from their taxes. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. You'll need to show that you've had. It medical expense form starts off with the patient's general information. Can you claim medical expenses on your taxes this year? The charges accumulated by the patient are listed down in the next section. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. First, calculate agi by following instructions found on the first page of form 1040. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. Many medical expenses are tax deductible if you itemize deductions. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses.

Free Medical Bill Receipt Template Pdf Word Eforms Free Fillable Forms , How Medical And Dental Expenses Are Deducted From Federal Taxes And What Is Deductible Or Not Deductible.

Support Faq Rocky Mountain Reserve. You'll need to show that you've had. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. It medical expense form starts off with the patient's general information. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. The charges accumulated by the patient are listed down in the next section. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. Here's how someone deducts medical expenses from their taxes. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. First, calculate agi by following instructions found on the first page of form 1040. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. Can you claim medical expenses on your taxes this year? Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. Many medical expenses are tax deductible if you itemize deductions.

Are Property Taxes Deductible Guide Millionacres . When Saving For Retirement Or Trying To Create A Budget For Yourself Or Your Senior Parents, Planning For Medical Expenses Can Be A Guess At Best.

Form 21p 8416 Medical Expense Report. Many medical expenses are tax deductible if you itemize deductions. Can you claim medical expenses on your taxes this year? If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. Here's how someone deducts medical expenses from their taxes. You'll need to show that you've had. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. The charges accumulated by the patient are listed down in the next section. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. First, calculate agi by following instructions found on the first page of form 1040. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. It medical expense form starts off with the patient's general information.

Employee Expense Reimbursement Policy Template : Many Medical Expenses Are Tax Deductible If You Itemize Deductions.

Workers Compensation Patient Forms Premier Healthcare Sports Clinic. The charges accumulated by the patient are listed down in the next section. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. It medical expense form starts off with the patient's general information. Can you claim medical expenses on your taxes this year? Many medical expenses are tax deductible if you itemize deductions. Here's how someone deducts medical expenses from their taxes. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. First, calculate agi by following instructions found on the first page of form 1040. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. You'll need to show that you've had. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions.

Medical Invoice Template Pdf Templates Jotform , If You Pay Medical Expenses That Are Not Covered By The State Or By Private Health Insurance A Medical Form Med2 (Pdf) Is A Receipt To Prove Your Dental Expenses.

Medical History Form Template Jotform. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. First, calculate agi by following instructions found on the first page of form 1040. Can you claim medical expenses on your taxes this year? Many medical expenses are tax deductible if you itemize deductions. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. Here's how someone deducts medical expenses from their taxes. The charges accumulated by the patient are listed down in the next section. You'll need to show that you've had. It medical expense form starts off with the patient's general information. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a.

Form 21p 8416 Medical Expense Report - The Question Asks About Reimbursement For Expenses, Not Paying Benefits For Death, Dismemberment, Or Loss Of Income.

Section 125 Flexible Benefit Plan Expense Reimbursement Voucher. The charges accumulated by the patient are listed down in the next section. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. It medical expense form starts off with the patient's general information. Can you claim medical expenses on your taxes this year? If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. You'll need to show that you've had. Many medical expenses are tax deductible if you itemize deductions. Here's how someone deducts medical expenses from their taxes. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. First, calculate agi by following instructions found on the first page of form 1040.

Repeal Of Medical Deduction Prompts Tax Bill Pushback , First, Calculate Agi By Following Instructions Found On The First Page Of Form 1040.

Free 5 Medical Receipt Templates In Pdf. Can you claim medical expenses on your taxes this year? If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. Many medical expenses are tax deductible if you itemize deductions. It medical expense form starts off with the patient's general information. The charges accumulated by the patient are listed down in the next section. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. Here's how someone deducts medical expenses from their taxes. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. First, calculate agi by following instructions found on the first page of form 1040. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. You'll need to show that you've had.

Section 125 Flexible Benefit Plan Expense Reimbursement Voucher - They Make Payments Directly To The Providers Of.

Handling Irs Medical Expense Deductions Tango Health Tango Health. Medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and prescriptions. The next section of the form asks for details related to the patient's health the diagnosis is required to be disclosed within the medical expense form. First, calculate agi by following instructions found on the first page of form 1040. The charges accumulated by the patient are listed down in the next section. Many medical expenses are tax deductible if you itemize deductions. The irs defines qualifying medical expenses as those related to the diagnosis, cure, mitigation, treatment, or prevention of a disease or condition affecting any part or function of the body. Can you claim medical expenses on your taxes this year? It medical expense form starts off with the patient's general information. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and. Here's how someone deducts medical expenses from their taxes. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers' compensation appeals board. If you have been paying a lot for health care recently, you may be glad to learn that many of those expenses could qualify as deductible from your taxable income on form 1040, schedule a. You'll need to show that you've had. Medical expenses include dental expenses, and in this publication the term medical expenses is often used to refer to medical and dental expenses. Use this checklist to determine which medical expenses you can take as a deduction on your income tax return.