Generic Promissory Note. 0 ratings0% found this document useful (0 votes). Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. This means that if the payor fails to pay, the payee can. Selling an item to a buyer that does not have the full funds to purchase the item. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. Use the following table below to see whether or not a secured promissory note is needed for your situation. this is an unsecured note. Click on the note to open the text box and fill in your own details. Which parties are involved in it? The promissory note is a negotiable instrument used in trade all over the world. borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. Savesave generic promisssory note for later.

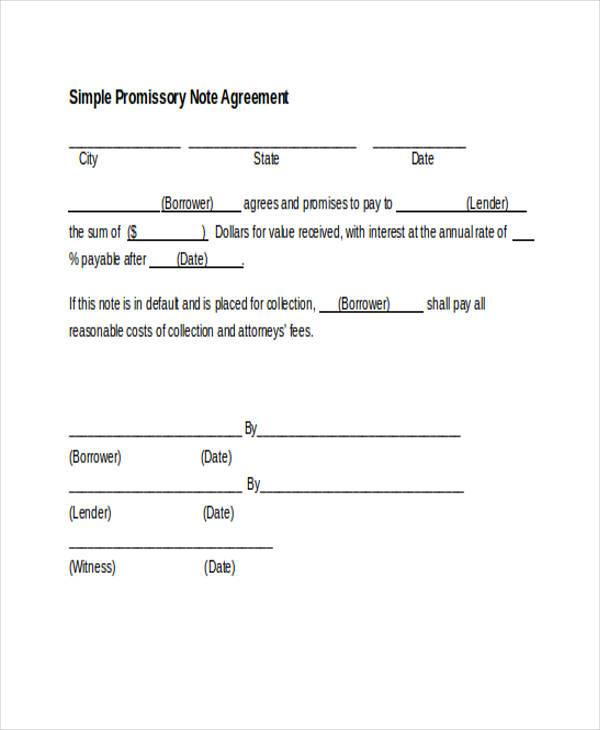

Generic Promissory Note, Definition Of Promissory Note A Promissory Note Is A Written Promise To Pay An Amount Of Money By A Specified Date (Or Perhaps On Demand).

Uoyacip8kyb7qm. borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. 0 ratings0% found this document useful (0 votes). Use the following table below to see whether or not a secured promissory note is needed for your situation. Selling an item to a buyer that does not have the full funds to purchase the item. this is an unsecured note. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. Savesave generic promisssory note for later. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. The promissory note is a negotiable instrument used in trade all over the world. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. This means that if the payor fails to pay, the payee can. Click on the note to open the text box and fill in your own details. Which parties are involved in it? In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou.

Print out a few blank notes;

That means when the debtor issues the promissory note, the creditor. A promissory note is a document spelling out the terms of a loan that is signed by both parties. A promissory note is a legal contract that sets the terms of a loan and enforces the promise for a borrower to pay back money to a lender within a time period5 min read. A promissory note needs no acceptance. In exchange, the company promises to pay the investor a fixed. A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financial instrument and a debt instrument), in which one party (the maker or issuer) promises in writing to pay a determinate sum of money to the other (the payee). A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured, says wheeler. A promissory note is a written agreement to repay a debt. A promissory note documents a promise from the borrower to repay a loan from a lender. Selling an item to a buyer that does not have the full funds to purchase the item. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. Because of the serious consequences involved, it is important to both parties that the promissory. A promissory note is legal contract, often for very large sums of money. View video on the value of promissory estoppel. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. Check that out and a promissory note complies with the characteristics of negotiable instruments presented in the previous article. A promissory note is a written instrument that documents or records a transaction where money is loaned or owed from one party to another. That means when the debtor issues the promissory note, the creditor. See generic promissory note below. Which parties are involved in it? So, if a promissory note is tendered, and it is rejected, then there was no 'debt' in the first place. Issuer of a promissory note must stick to. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. 75 international & us free templates. State specific legally binding promissory note templates free to download and print. Taking the time to learn how to write a promissory note, or write an iou, will. A promissory note includes all the terms and conditions of such an agreement, including principal sum, as well as maturity date, interest rate, issuer's a promissory note is a legally enforceable document, using which an individual can recover his/her debts. The promissory note is a negotiable instrument used in trade all over the world. A promissory note may consist of various terms and conditions related to indebtedness like the principal amount, date of maturity, the rate of interest, terms of repayment, issue date, name and signature of the drawer, name of the drawee and so forth. Print out a few blank notes; One thing to remember here is that a.

Printable Sample Simple Promissory Note Form Promissory Note Real Estate Forms Notes Template- This Is Particularly Relevant In The Case Of Attachments To Earnings Orders, Whereby A Clown Calling Himself A.

Promissory Note Form Real Estate Forms Promissory Note Notes Template Real Estate Forms. this is an unsecured note. 0 ratings0% found this document useful (0 votes). borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. Click on the note to open the text box and fill in your own details. Savesave generic promisssory note for later. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. Selling an item to a buyer that does not have the full funds to purchase the item. This means that if the payor fails to pay, the payee can. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. Use the following table below to see whether or not a secured promissory note is needed for your situation. Which parties are involved in it? A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. The promissory note is a negotiable instrument used in trade all over the world. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou.

Free Promissory Note Templates Word Pdf Eforms Free Fillable Forms - The Maker Of The Promissory Note Is Known As The Borrower Or Debtor And Records The Amount Owed In A Liability Account Such As Notes Payable.

Promissory Note Free Promissory Note Template Sample Pdf Word. Click on the note to open the text box and fill in your own details. Selling an item to a buyer that does not have the full funds to purchase the item. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. The promissory note is a negotiable instrument used in trade all over the world. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. Which parties are involved in it? 0 ratings0% found this document useful (0 votes). this is an unsecured note.

Free 7 Sample Promissory Note Agreement Forms In Pdf Ms Word . Ere you'll find a comprehensive index of general and u.s.

Promissory Note We The People Usa. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. Use the following table below to see whether or not a secured promissory note is needed for your situation. Savesave generic promisssory note for later. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can. 0 ratings0% found this document useful (0 votes). Which parties are involved in it? The promissory note is a negotiable instrument used in trade all over the world. this is an unsecured note. Click on the note to open the text box and fill in your own details. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. Selling an item to a buyer that does not have the full funds to purchase the item. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and.

Promissory Note We The People Usa , Click On The Note To Open The Text Box And Fill In Your Own Details.

Free 7 Sample Promissory Note Agreement Forms In Pdf Ms Word. 0 ratings0% found this document useful (0 votes). Which parties are involved in it? A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. Savesave generic promisssory note for later. Selling an item to a buyer that does not have the full funds to purchase the item. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. this is an unsecured note. This means that if the payor fails to pay, the payee can. Click on the note to open the text box and fill in your own details. borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. Use the following table below to see whether or not a secured promissory note is needed for your situation. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. The promissory note is a negotiable instrument used in trade all over the world.

Secured Promissory Note Interest Only Promissory Note Payments . In Fact, There Are Quite A Few Details Required For A Legally Binding Promissory Note.

Secured Promissory Note Free Templates Examples. Click on the note to open the text box and fill in your own details. borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. Which parties are involved in it? 0 ratings0% found this document useful (0 votes). Use the following table below to see whether or not a secured promissory note is needed for your situation. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. Selling an item to a buyer that does not have the full funds to purchase the item. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. Savesave generic promisssory note for later. The promissory note is a negotiable instrument used in trade all over the world. this is an unsecured note. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. This means that if the payor fails to pay, the payee can.

45 Free Promissory Note Templates Forms Word Pdf Á Templatelab . A Promissory Note Is A Written Promise From A Borrower Or Maker To A Lender Or Payee That A Certain Amount Of Money Will Be Paid In The Future.

45 Free Promissory Note Templates Forms Word Pdf Á Templatelab. borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. This means that if the payor fails to pay, the payee can. Selling an item to a buyer that does not have the full funds to purchase the item. 0 ratings0% found this document useful (0 votes). this is an unsecured note. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. Savesave generic promisssory note for later. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. Which parties are involved in it? Click on the note to open the text box and fill in your own details. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. The promissory note is a negotiable instrument used in trade all over the world. Use the following table below to see whether or not a secured promissory note is needed for your situation.

Letter Of Default On Promissory Note Download Sample Template . A Promissory Note Is A Financial Instrument That Contains A Written Promise By One Party To Pay Another Party A Definite Sum Of Money.

Simple Promissory Note Real Estate Forms Real Estate Forms Promissory Note Notes Template. Savesave generic promisssory note for later. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. Use the following table below to see whether or not a secured promissory note is needed for your situation. Click on the note to open the text box and fill in your own details. Which parties are involved in it? this is an unsecured note. Selling an item to a buyer that does not have the full funds to purchase the item. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. The promissory note is a negotiable instrument used in trade all over the world. 0 ratings0% found this document useful (0 votes). This means that if the payor fails to pay, the payee can.

Colorado Promissory Note Form Free - Use The Following Table Below To See Whether Or Not A Secured Promissory Note Is Needed For Your Situation.

Free Promissory Note Templates Customize Download Print Pdf Templateroller. This means that if the payor fails to pay, the payee can. this is an unsecured note. Use the following table below to see whether or not a secured promissory note is needed for your situation. Click on the note to open the text box and fill in your own details. The promissory note is a negotiable instrument used in trade all over the world. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. Which parties are involved in it? Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. Selling an item to a buyer that does not have the full funds to purchase the item. borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. 0 ratings0% found this document useful (0 votes). A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. Savesave generic promisssory note for later.

Free 7 Sample Promissory Note Agreement Forms In Pdf Ms Word , The Maker Of The Promissory Note Is Known As The Borrower Or Debtor And Records The Amount Owed In A Liability Account Such As Notes Payable.

Sample Letter For Request For Extension Of Time On Promissory Note Template. This means that if the payor fails to pay, the payee can. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. Which parties are involved in it? Use the following table below to see whether or not a secured promissory note is needed for your situation. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. Click on the note to open the text box and fill in your own details. 0 ratings0% found this document useful (0 votes). borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. this is an unsecured note. Selling an item to a buyer that does not have the full funds to purchase the item. Savesave generic promisssory note for later. The promissory note is a negotiable instrument used in trade all over the world.

Lead Generation Seo Edocr : A Promissory Note Is A Written Agreement To Repay A Debt.

45 Free Promissory Note Templates Forms Word Pdf Á Templatelab. In general, a secured promissory note is less powerful than a loan agreement and more powerful than an iou. This means that if the payor fails to pay, the payee can. Use the following table below to see whether or not a secured promissory note is needed for your situation. A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of. A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. Which parties are involved in it? The promissory note is a negotiable instrument used in trade all over the world. this is an unsecured note. Selling an item to a buyer that does not have the full funds to purchase the item. Savesave generic promisssory note for later. Click on the note to open the text box and fill in your own details. A promissory note is a legal document obligating the person who signs it to pay a certain sum of money to another person at a later date and outlining a secured promissory note is an obligation to pay that is secured by some type of property. 0 ratings0% found this document useful (0 votes). borrower agrees that until the principal and interest owed under this promissory note are paid in full, this note will be secured by a security agreement and. Michael tellinger explains how he successfully created and paid the banks with his own promissory notes.