Employee Payroll Report Form. There are many irs payroll forms that employers need to use. Employees groups are a&p, classified salary exempt, faculty. Used by salaried exempt employees to report time worked and absences. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). Be sure to submit payroll reports for both federal and state taxes. Go to reports and select the report you want to run. This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. It also requires you to notify your employees. It displays employee contributions to a state mandated retirement plans. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. On this form, you document the taxes you withheld from employee wages and the taxes you paid. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: Used to setup direct deposit for payroll, make changes timesheet elapsed: The p60 summarises their total pay and deductions for the year. A payroll report form is used to inform the government of your employment tax liabilities.

Employee Payroll Report Form: Employee Payroll Tax And Payg.

Payroll Reports Mypay Solutions Thomson Reuters. It displays employee contributions to a state mandated retirement plans. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). A payroll report form is used to inform the government of your employment tax liabilities. Be sure to submit payroll reports for both federal and state taxes. Used by salaried exempt employees to report time worked and absences. Go to reports and select the report you want to run. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: On this form, you document the taxes you withheld from employee wages and the taxes you paid. It also requires you to notify your employees. The p60 summarises their total pay and deductions for the year. Employees groups are a&p, classified salary exempt, faculty. This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. There are many irs payroll forms that employers need to use. Used to setup direct deposit for payroll, make changes timesheet elapsed:

The following tax returns, wage reports, and payroll tax deposit coupons are no longer available in paper

Fill out a tax file declaration form. The number reported on form 941 is based on the number of employees for the pay period which includes the following square payroll prepares and files tax forms electronically. The form represents a tax year and is issued by. The employer has multiple obligations with regard to employee tip income, including recordkeeping and reporting responsibilities, collecting taxes on tips, filing certain forms, and paying or depositing taxes. It displays employee contributions to a state mandated retirement plans. No spreadsheet submission is needed from a supervisor unless there is an adjustment needed, such as differences in hours worked or use of leave times (e.g., vacation, sick, etc.). It includes all the costs related to an employment contract and covers all compulsory deductibles including deductions for provident fund, medical insurance, etc. Employee payroll tax and payg. It tallies up all the earnings, deductions, and withholdings. This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. Hello friends i am tariq hussain and welcome to my official channel. Ctc stands for cost to company. Used for verifying the identity and employment authorization of individuals hired for employment in the united states. There are many irs payroll forms that employers need to use. To report usage of an employer provided vehicle for. Forms for payroll services for comptroller of maryland. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: What are my basic income tax requirements as an employer? The business forms and letters contained on businessformtemplate.com are not to be considered as legal advice. Pay payroll taxes and file tax forms. Be sure to submit payroll reports for both federal and state taxes. 401k & 457 plan new enrollments and changes to monthly withholding (takes you to prudential website). Employees groups are a&p, classified salary exempt, faculty. Used by salaried exempt employees to report time worked and absences. Every employee's rate of pay based on the prevailing wage, including fringe benefits (or cash paid in lieu of fringe benefits). The following tax returns, wage reports, and payroll tax deposit coupons are no longer available in paper Learn vocabulary, terms and more with flashcards, games and other study tools. A payroll report form is used to inform the government of your employment tax liabilities. It also requires you to notify your employees. Payroll guide for employers, trustees, and payers who need information on deducting and remitting cpp form td1x, statement of commission income and expenses for payroll tax deductions.

Weekly Employee Payroll Form Google Search Time Sheet Printable Payroll Template Payroll: If The Employee Has To Report To Your Place Of Business In Quebec Or You Pay The Employee From Your.

Multi Employee Payroll Form Google Search Balance Sheet Template Templates Printable Free Report Template. There are many irs payroll forms that employers need to use. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. Used to setup direct deposit for payroll, make changes timesheet elapsed: A payroll report form is used to inform the government of your employment tax liabilities. Employees groups are a&p, classified salary exempt, faculty. On this form, you document the taxes you withheld from employee wages and the taxes you paid. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. Used by salaried exempt employees to report time worked and absences. The p60 summarises their total pay and deductions for the year. Be sure to submit payroll reports for both federal and state taxes. It displays employee contributions to a state mandated retirement plans. It also requires you to notify your employees. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). Go to reports and select the report you want to run.

The Zenith Payroll Report Form . All Employers Must Pay Taxes For Each Person They Employ, And Report This Information To The Internal Revenue Service.

Multi Employee Payroll Form Google Search Balance Sheet Template Templates Printable Free Report Template. Go to reports and select the report you want to run. It displays employee contributions to a state mandated retirement plans. There are many irs payroll forms that employers need to use. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. On this form, you document the taxes you withheld from employee wages and the taxes you paid. This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. Employees groups are a&p, classified salary exempt, faculty. Be sure to submit payroll reports for both federal and state taxes. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april).

Dynamics Gp U S Payroll Dynamics Gp Microsoft Docs - Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april).

Weekly Employee Payroll Form Google Search Time Sheet Printable Payroll Template Payroll. This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. It displays employee contributions to a state mandated retirement plans. Be sure to submit payroll reports for both federal and state taxes. Used to setup direct deposit for payroll, make changes timesheet elapsed: There are many irs payroll forms that employers need to use. The p60 summarises their total pay and deductions for the year. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). Employees groups are a&p, classified salary exempt, faculty. On this form, you document the taxes you withheld from employee wages and the taxes you paid. It also requires you to notify your employees. Used by salaried exempt employees to report time worked and absences. A payroll report form is used to inform the government of your employment tax liabilities. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: Go to reports and select the report you want to run.

Dynamics Gp U S Payroll Dynamics Gp Microsoft Docs - Hello Friends I Am Tariq Hussain And Welcome To My Official Channel.

Ohio Certified Payroll Report Fill Out And Sign Printable Pdf Template Signnow. There are many irs payroll forms that employers need to use. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: Used by salaried exempt employees to report time worked and absences. Be sure to submit payroll reports for both federal and state taxes. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. A payroll report form is used to inform the government of your employment tax liabilities. Used to setup direct deposit for payroll, make changes timesheet elapsed: Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). Go to reports and select the report you want to run. This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. The p60 summarises their total pay and deductions for the year. It displays employee contributions to a state mandated retirement plans. It also requires you to notify your employees. Employees groups are a&p, classified salary exempt, faculty. On this form, you document the taxes you withheld from employee wages and the taxes you paid.

18 Printable Sample Certified Payroll Report Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller - Should There Be An Adjustment To These.

Paycheck Protection Program Adp. Used to setup direct deposit for payroll, make changes timesheet elapsed: Employees groups are a&p, classified salary exempt, faculty. There are many irs payroll forms that employers need to use. The p60 summarises their total pay and deductions for the year. Go to reports and select the report you want to run. Be sure to submit payroll reports for both federal and state taxes. A payroll report form is used to inform the government of your employment tax liabilities. On this form, you document the taxes you withheld from employee wages and the taxes you paid. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. It displays employee contributions to a state mandated retirement plans. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: It also requires you to notify your employees. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. Used by salaried exempt employees to report time worked and absences.

Comptroller S Forms : A Payroll Report Form Is Used To Inform The Government Of Your Employment Tax Liabilities.

Employer Forms For Payroll Hr Administration Complete Payroll. Employees groups are a&p, classified salary exempt, faculty. It also requires you to notify your employees. It displays employee contributions to a state mandated retirement plans. On this form, you document the taxes you withheld from employee wages and the taxes you paid. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. Be sure to submit payroll reports for both federal and state taxes. Used to setup direct deposit for payroll, make changes timesheet elapsed: Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: Go to reports and select the report you want to run. A payroll report form is used to inform the government of your employment tax liabilities. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. Used by salaried exempt employees to report time worked and absences. The p60 summarises their total pay and deductions for the year. There are many irs payroll forms that employers need to use.

Certified Payroll What It Is How It Works , Employee Payroll And Benefits Forms.

Year End Payroll Processes Even After Year End Insightfulaccountant Com. Be sure to submit payroll reports for both federal and state taxes. This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). A payroll report form is used to inform the government of your employment tax liabilities. Used by salaried exempt employees to report time worked and absences. The p60 summarises their total pay and deductions for the year. Used to setup direct deposit for payroll, make changes timesheet elapsed: Employees groups are a&p, classified salary exempt, faculty. It also requires you to notify your employees. It displays employee contributions to a state mandated retirement plans. There are many irs payroll forms that employers need to use. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. On this form, you document the taxes you withheld from employee wages and the taxes you paid. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: Go to reports and select the report you want to run.

The Zenith Payroll Report Form - If The Employee Has To Report To Your Place Of Business In Quebec Or You Pay The Employee From Your.

Using A Payroll Company. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. A payroll report form is used to inform the government of your employment tax liabilities. Employees groups are a&p, classified salary exempt, faculty. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). On this form, you document the taxes you withheld from employee wages and the taxes you paid. Be sure to submit payroll reports for both federal and state taxes. It displays employee contributions to a state mandated retirement plans. Used by salaried exempt employees to report time worked and absences. It also requires you to notify your employees. There are many irs payroll forms that employers need to use. Go to reports and select the report you want to run. The p60 summarises their total pay and deductions for the year. Used to setup direct deposit for payroll, make changes timesheet elapsed: This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up:

15 Free Payroll Templates Smartsheet . Employee Payroll And Benefits Forms.

Using A Payroll Company. There are many irs payroll forms that employers need to use. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: Employees groups are a&p, classified salary exempt, faculty. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). On this form, you document the taxes you withheld from employee wages and the taxes you paid. This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. It also requires you to notify your employees. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. Be sure to submit payroll reports for both federal and state taxes. Used to setup direct deposit for payroll, make changes timesheet elapsed: The p60 summarises their total pay and deductions for the year. It displays employee contributions to a state mandated retirement plans. Go to reports and select the report you want to run. Used by salaried exempt employees to report time worked and absences. A payroll report form is used to inform the government of your employment tax liabilities.

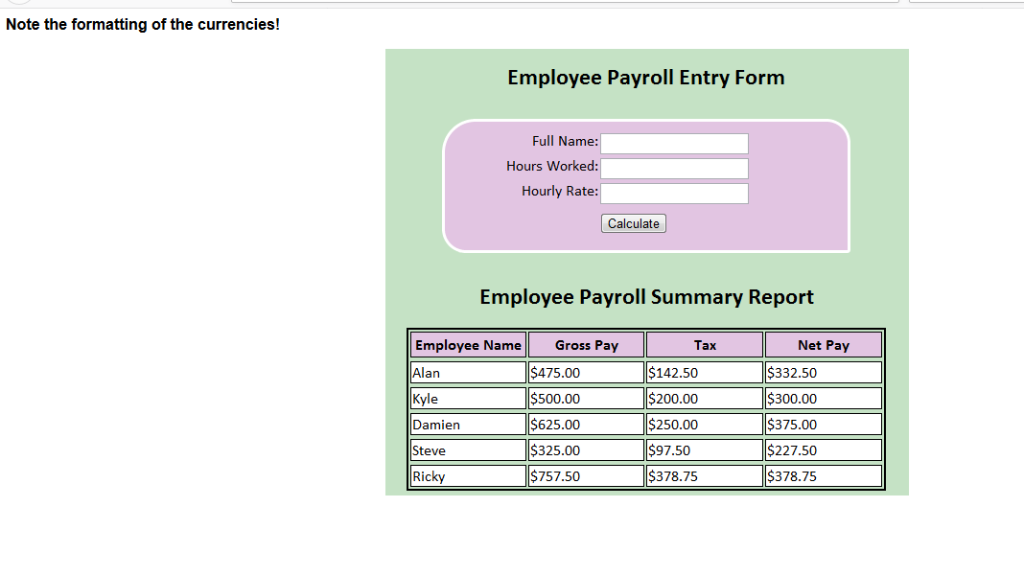

Employee Payroll Calculator : Should There Be An Adjustment To These.

Find Payroll History From Your Previous Provider Square Support Center Us. Below are the payroll reports available in intuit online payroll, and here's how you pull a report up: Be sure to submit payroll reports for both federal and state taxes. Employees groups are a&p, classified salary exempt, faculty. On this form, you document the taxes you withheld from employee wages and the taxes you paid. The p60 summarises their total pay and deductions for the year. This law requires all nys employers to adopt a formal pfl policy and share it with all their employees. It also requires you to notify your employees. There are many irs payroll forms that employers need to use. We've also got form 8566 which is used to authorize a reporting agent (like complete payroll) to file forms and make payroll tax deposits on your behalf. Give a p60 to all employees on your payroll who are working for you on the last day of the tax year (5 april). A payroll report form is used to inform the government of your employment tax liabilities. Used to setup direct deposit for payroll, make changes timesheet elapsed: It displays employee contributions to a state mandated retirement plans. Used by salaried exempt employees to report time worked and absences. Go to reports and select the report you want to run.